Today the ongoing question for real estate development professions is common….should we create rental or condo buildings? With a consistently increasing interest rate environment and stagnant income growths, the market for condo sales seems to get tighter and tighter. On the other hand, the supply of rental buildings created in New York City, and particularly in Brooklyn, does give some indication that there may be an oversupply problem.

According to the Elliman Q2 Report, condo sales prices are down 7.5%, and inventory is up 10.7%. The fear of the condo market turning into negative territory is real and tangible. However, there are still neighborhoods where the purchase of a residential home is still a bargain proposition. In particular, communities in a rapid transition with a new population with higher incomes.

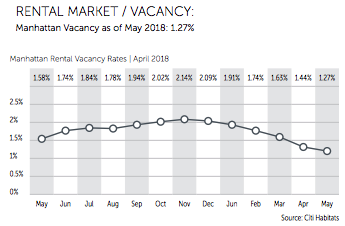

According to Ariel Property Advisors Q2 Report, the rental market vacancy rate in Manhattan continues to trend in a positive direction.  The difficulty is purchasing land at a price that is conducive to market rate rental products. Very often some level of affordability is required to attain high bonuses like inclusionary housing or real estate tax abatements such the program formerly known as 421a. Many are finding joint ventures and non-profit organizations as their avenue to achieve feasible rental projects.

The difficulty is purchasing land at a price that is conducive to market rate rental products. Very often some level of affordability is required to attain high bonuses like inclusionary housing or real estate tax abatements such the program formerly known as 421a. Many are finding joint ventures and non-profit organizations as their avenue to achieve feasible rental projects.

Lastly, the trends in cities around America and the globe are all leaning toward more city jobs. Technology and Finance jobs continue to grow and lead the world in employment production. New York City is one of the hubs that have both. Thus those individuals will need to live somewhere either to rent or to purchase. So for local developers, this is a sign of good things to come.