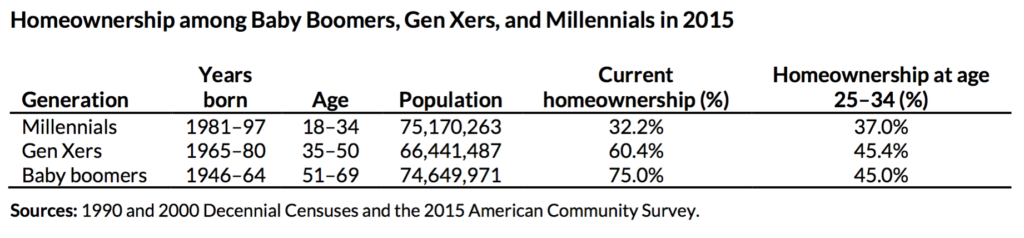

Millennials are now over 75 million, the largest generation in US History. Compared to previous generations, they’re more educated, more tech-savvy, more racially and ethnically diverse. They are marrying and having children later in life. Many millennials, 21 to 38, are entering their peak household formation years and home buying years, yet they’re doing both at a much smaller rate than previous generations. There are a variety of factors involved in this demographic shift.

Delayed marriage has made a significant impact on their home ownership trend. People who are married are 18% more likely to own a home. The marriage rate amount young adults dropped from 52 percent to 39 percent with this generation. With two households they have a larger capacity to come up with the downpayment.

The downside of them being more educated is the weight of student loan debt. The cost of education has increased dramatically from previous generations. Also, a bachelor degree was enough to generate enough income to support a family. Still, those college educated tend to have a better quality of life economically in the long run, it’s just taking them longer to get away from the burden of student debt.

Many millennials have also chosen to live in high rent metropolitan cities. During the 21st century, young adults have moved to major urban hubs for employment and urban amenities. In these locations, there’s a higher demand and higher cost for the supply. This more sharply acute amount higher educated millennials but even less educated have a significant drop in homeownership.

Historically in America, homeownership has been linked to stable living, a hedge against inflation, and the path to building wealth. This trend and the resulting economic impacts must be closely watched. The economic health of the next generation is yet to be defined. Creating housing options for them is a moving target no one has focused on successfully. That is a massive opportunity.